Re(2): 'Budget Deficit Estimation...', BoghieOnYourSix, Me

Re(3): 'Response to 'Liberal and Loving It' - Ranking the American Presidents', Me

Re(4): 'Fiscal Flameout???', BoghieOnYourSix, Me

Re(5): 'Bush's Promise - To cut the deficit in half by FY2009', BoghieOnYourSix, Me

Re(6): 'Pull This Finger, Will You', BoghieOnYourSix, Me

Re(7): 'Eeyore Covers the Budget', PowerLineBlog, John Hinderaker

UPDATE: Brad DeLong removes a comment by me from his Blog

Re(8): 'Althouse.... The Stupidity Rays... Are Overwhelming...', Brad DeLong

Nice Try NYT!!!

You get a Smiley Face

So evil corporate income tax has almost tripled during the Bush Economic Blight, and individual income tax revenue has grown substantially. And, the deficit is shrinking rather dramatically in this era of war and corruption. That is something you have to admit – but great grudge work and slight of hand.

So your fine article deserves a Fisking!!!

Here is the Gist of your Argument – as mouthpiece for the Loony Left:

Democrats and many independent budget analysts note that overall revenues have barely climbed back to the levels reached in 2000, and that the government has borrowed trillions of dollars against Social Security surpluses just as the first of the nation's baby boomers are nearing retirement.For most of the article the NYT uses numbers from FY2001 (the last Clinton budget – a point never made), but here they choose to use FY2000 numbers. Why??? Because in the context of later discussions the NYT denigrates the revenue increase as being the result of rich people selling stocks and bonds – that is, investment taxes. Thus, doom is around the corner.

But, hey look at this hand will you… Not that hand stupid… Over here we are talking about the last Great Man’s personal income tax revenues coming in at a mite over 1 Trillion dollars. And while we are talking about a huge increase in FY2006 revenues we shall pull the FY2005 revenues out of the hat over here. See, that Monkey of a President only yanked $927 Billion out of your wallet. Quiet about the earlier comment we had to make about the growth in all forms of revenue since last year… Stop looking at the Monkey bringing in over $1 Trillion this year – it must be a clerical mistake.

When will you audiences suspend disbelief and just watch the show. We had to tell you about evil corporations paying three times as much tax than they did in FY2001. Look at FY2000 where they were forced to redistribute $207 Billion. Shut up about projections of Halliburton et al greasing the skids to the tune of $350 Billion for FY2006. Look at this hand, please…

Over here, President BusHitler hasn’t even come to Clinton’s second to final numbers. This chump only brought in $927 Billion last year in individual income taxes and an obvious one-off of $278 Billion from Halliburton’s war profiteering.

Let us continue:

Mr. Kahn et al, please take in this set of numbers (and we even forget about the subsequent damage caused by 9/11 and Katrina – I can’t figure out why the numbers looked so bad after 9/11 and pre-2003 tax changes):"The fact is that revenues are way below what the administration said they would be a few years ago," said Thomas S. Kahn, staff director for Democrats on the House Budget Committee. "The long-term prognosis is still very, very bleak, and the administration doesn't have any kind of long-term plan."

One reason the run-up in taxes looks good is because the past five years looked so bad. Revenues are up, but they have lagged well behind economic growth.

The surge could also evaporate as quickly as it appeared. Over the past decade, tax

revenues have become much more volatile, alternately soaring and plunging in the

wake of swings in the stock market and repeatedly defying government projections.

Note the growth in GDP, Individual Income Tax, Corporate Income Tax, DOD expenditures, and Social Security expenditures.FY2001 (President Clinton’s last budget, in billions)

GDP: 10,128

Individual Income Tax: 994

Corporate Income Tax: 151

Total Revenues: 1,990

DOD Expenditures: 290

Social Security Expenditures: 489

Deficit: +127 (surplus)FY2006 estimate (current budget, in billions)

GDP: 13,100

Individual Income Tax: 1,027

Corporate Income Tax: 352

Total Revenues: 2,375

DOD Expenditures: 512

Social Security Expenditures: 603

Deficit: -280(deficit)

Here is something to think about. Let us balance the budget! First, index Social Security Benefits to inflation rather than wages and bring them to balance with receipts and investment growth. Then cut our Defense budget in half. That will fix it. What, you will not talk about Social Security and you cannot politically cut the DOD budget. Then what are you going to do? Don’t know.

My guess is that President Bush figures 9/11 and Katrina are rare events. So, President Bush is figuring that if the economy grows at the steady and sustainable rate his administration is promoting - while spending is being brought steadily and sustainably under control - than the deficit will shrink. Not a bad idea – where is yours?

But, remember one must look at my right hand when I gesture with it – don’t look at my left hand. My right hand is showing increasing government spending while my left hand illustrates a shrinking deficit – both in real terms and as a ratio. I can’t see the pattern. I am lost. I am thinking like Bill Keller and the rest of the word smiths and Congressional Intelligencia – that is, I ain’t got no idea what numbers and trends mean.

So, for the John Kerry’s of the world here is a nice little chart:

| Fiscal Year | GDP | Tax Revenue | Deficit | % of GDP | % of Tax Revenue |

| FY2004 | 11,743 | 1,798 | 412 | 3.51% | 22.91% |

| FY2005 | 12,479 | 2,053 | 318 | 2.55% | 15.49% |

| FY2006 | 13,400 | 2,285 | 286 | 2.13% | 12.52% |

That chart implies that economic and revenue growth is expanding faster that even drunken Republicans can spend it. And, let us not forget Senator Landrieu’s demand for more Katrina relief – remember she wanted $200 Billion more than she got. So where would we be if the other drunks were in power?

I guess this about sums up the MediaCrat opinion:

Tax receipts amounted to about 17.5 percent of the nation's gross domestic product in 2005, far below the level five years ago and still slightly below the average of 18 percent since World War II. Spending, by contrast, is running at about 20 percent of gross domestic product .

The recent average for tax receipts is 18 percent – so 17.5 percent is a significant cut to the NYT (please refer to NYT stock price). And, what about Clinton’s sustainable DotCom boom ratio of 20.6 percent. That is certainly sustainable – especially when it is almost 3 percent over norm and there are no wars, no massive natural disasters, and no recession.

And we will be at war forever, and have cities wiped off the map every year, and economic doom is just around the corner.

Makes sense to me!!!

But, then again, we might draw down our troops in Iraq, the weather might be balmy and sweet, and the recent downturn in the stock market might point to those rich bastards (and me) selling appreciated stock and paying those damn capital gains taxes…

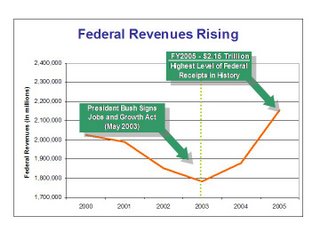

And, then I ran across this telling chart at PowerLine:

That makes even more sense to me!!!

Note:

One last comment, the shrinking deficit and growing revenues are not surprising. My numbers for FY2006 are from February and I easily predicted the actual deficit numbers for FY2005. Mr. Andrews should take some time out of his CommonDreams and DailyKOS reads and check out some primary sources. I am eternally grateful to Jayson (formerly of PoliPundit) for directing me to the primary data in his 'Hooverville' posts.

UPDATE: (2006/07/09 2151)

I just had the honor of haveng a version of the above removed as a comment in a Brad DeLong's blog post titled 'Althouse.... The Stupidity Rays... Are Overwhelming...'. The honor of it all... But, I put some time in it. Guess he didn't like the fact that I called him on some opinion or another - but I definitely didn't Frisch him. The only time that has ever happened to me in the past was when the Huffington Post ran an article about the rich using loopholes to avoid taxes. I had to post a comment with a link to her public tax records (she was running for Governor of California the year before) and mention that while she had 4.5 million in income she paid $700 in taxes - like a pig at the trough. To her credit, the post was restored. Kinda sneaky about it...

1 comment:

As usual you on on your game when it comes to Federal finances...not sure anyone puts it together any better!!! Nice post. MM

Post a Comment